SPV Mortgages: Simplify Property Financing For Sourcers

Simplifying property finance for sourcers and investors with our exclusive partnership with SPV Mortgages

Finance For Sourced and Packaged Properties Just Got Easier

With SPV Mortgages and NAPSA, sourcing agents and deal packagers can pre-assess mortgage viability for buyers quickly and easily.

Expand your finance options and nurture long-term working relationships with investor clients; all while helping to grow lender confidence in the property sourcing and deal packaging sectors.

How Does it Work?

By joining the SPV Mortgages pilot scheme, NAPSA Approved Members can find ideal mortgage products for their clients in just three simple stages.

By taking part in the scheme, you’ll also be helping NAPSA and SPV Mortgages to produce a comprehensive report on the property sourcing sector; including financing trends and the challenges holding agents back from finding suitable mortgage solutions.

Your data will help us unlock further mortgage options and enhanced solutions for sourcing agents just like you.

Simple Step-by-Step Process

SPV Mortgages will work with you every stepShare Your Deal Information

Share your deal specifics and SPV Mortgages will refer to their dedicated finance panel

Viability Checks Carried Out

Your deal specifics will be checked for viability through the off-market finance panel

Confirmation & Support

SPV Mortgages will provide feedback on the potential mortgage options, equipping sourcing agents with crucial insights to present investors confidently. You'll also have the opportunity for a 1-2-1 consultation to discuss your feedback and deal details with an expert.

Why This Matters for Property Sourcers

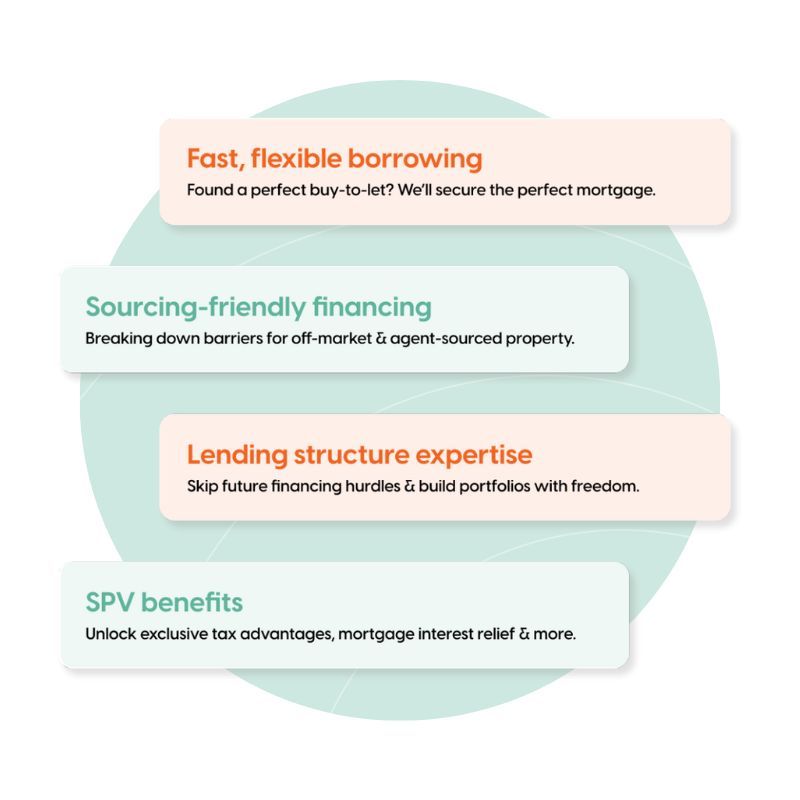

Finding affordable financing for agent-sourced and off-market property deals has been a significant challenge for property sourcers and deal packagers; with the majority of lenders rejecting applications immediately without a second glance.

Our new pilot scheme represents an opportunity to revolutionise the mortgage industry for property sourcers and their clients. NAPSA pre-approved members get fast, flexible, and exclusive access to the best financing solutions for their clients; tailored to suit their own unique property deals.

Give your investors access to thoroughly vetted properties, ensuring a smoother process and more informed decision-making; and enjoy future-proof lending structures that will keep investors coming back as they grow their portfolios.

Ready to Check Your Deal?

This service is completely free for NAPSA Approved Members to use. Once completed, please allow up to 2 working days for the team at SPV Mortgages to reply.

Start and Build Your Sourcing or Deal Packaging Business

Joining couldn't be simpler and we've provided two options depending on which stage you are at with your sourcing business.

Start Your Business

£998 +VAT

Get all of the knowledge, legally required training and documents you need to start a sourcing business confidently and the right way. This extensive and trusted course will equip you with the tools, processes and confidence to start your sourcing business effectively.

Build Credibility

£295 +VAT

Already have your training and documents in place? No problem, move straight to joining NAPSA and getting your business checked and searchable. Access exclusive member benefits, a raft of resources, and credibility in front of investors

Flexible Finance for Off-Market Deals

SPV Mortgages, in collaboration with NAPSA, is revolutionising financial solutions for sourcing agents and property investors. Our one-year pilot scheme is designed to tackle the unique challenges of financing properties procured by sourcing and deal packaging agents.

Together, we're creating a more inclusive finance market for sourcing agents and their clients.

More Information on Finance

SPV Mortgages share regular updates on the finance sector

Will Your Investor Get Finance?

Property finance can often feel daunting, especially when sourcing off-market deals. That's why NAPSA, in partnership with SPV Mortgages, has launched an all-new pilot scheme designed to empower property sourcers and deal packagers.

Save Time & Hassle Property Investing

Together with NAPSA, Jonathan has been working to break down the barriers to mortgage financing for property sourcing agents and their clients; particularly when it comes to property flip purchases. Here’s what he has to say about buy-to-flip investing – and how a NAPSA property sourcing agent could help you succeed in your next project.